Key Findings

- Capacity Disrupted: Ukrainian drone strikes from Dec 2-7, 2025, took an estimated 180,000 to 300,000 barrels per day (bpd) of Russian refining capacity offline.

- Critical Refining Unit Destroyed: The strike on the Ryazan refinery successfully destroyed the Izomalk-2-LIN-800 isomerization unit, a critical component for high-octane gasoline production. This specific unit will require an estimated 60-90 days for repair.

- Muted Global, Severe Domestic Impact: Global crude prices remained stable post-strike. However, the loss of production from these specific refineries directly contributes to Russia's ongoing domestic fuel shortages and price controls.

- Continued Hard Target Vulnerability: The successful ninth strike on the Ryazan refinery highlights the inability of current Russian air defenses to protect this specific high-value asset from repeated drone attacks.

Overview

Between December 2 and 7, 2025, Ukrainian forces executed a coordinated series of long-range drone strikes against three Russian energy infrastructure targets: the Ryazan oil refinery, the Syzran oil refinery, and the Livny oil storage depot. These attacks employed Ukraine's expanding arsenal of long-range one-way attack drones, including models such as the UJ-22 Airborne (800 km range) and UJ-26 Beaver (1,000 km range), which have become the primary weapons in a sustained campaign that has delivered over 180 strikes on Russian oil infrastructure in 2025 alone.

The attacks were executed in a coordinated sequence over a five-day period, targeting facilities with distinct operational profiles. The Livny depot strike on December 2 destroyed storage capacity. The Syzran refinery strike on December 5 triggered a large-scale fire that disrupted refining operations. The Ryazan refinery strike on December 6 destroyed a critical isomerization unit responsible for high-octane gasoline production. This marked the ninth successful penetration of air defenses at Ryazan in 2025, demonstrating a persistent vulnerability at one of Russia's most strategically important refineries.

The drone strikes of December 2-7, 2025, resulted in the functional degradation of two key Russian refineries, Ryazan and Syzran, with a combined estimated capacity loss of 240,000 bpd. The most significant outcome is the destruction of the Izomalk-2-LIN-800 isomerization unit at Ryazan, which will curtail high-octane gasoline production for an estimated 60-90 days and potentially longer given sanctions-related constraints on replacement parts.

Key Market Indicators (as of December 8, 2025)

While these strikes did not impact global crude prices, they directly removed 3.6-6.0% of Russian refining capacity from a domestic market already experiencing severe fuel shortages. The inability of Russian air defenses to prevent a ninth successful strike on the Ryazan facility indicates a persistent vulnerability at this critical node. The facility's proximity to Moscow and its strategic importance to regional fuel supply make this defensive failure particularly significant.

The cumulative effect of these strikes, combined with previous attacks throughout 2025, has forced the Russian government into emergency measures including export bans, price controls, and regional rationing. The shift from high-margin refined product exports to low-margin crude exports continues to degrade Russian oil revenues, which remain at their lowest levels since 2022.

Impacts on Facility Function

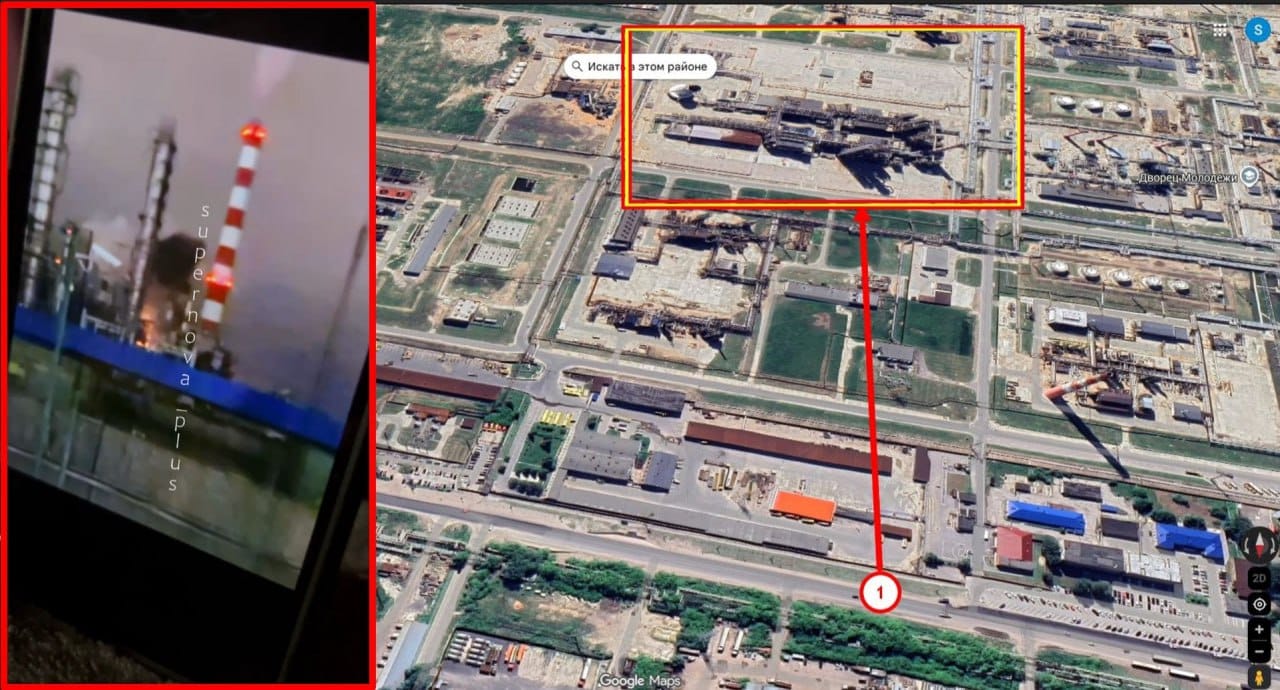

This assessment integrates visual evidence from commercially available satellite imagery with functional analysis of the targeted facilities and their ability to perform their intended missions following the Dec 2-7 strikes. Analysis of commercially available satellite imagery, open-source visual data, and on the ground reporting confirms significant damage to the targeted facilities.

| Facility | Damage Description | Status | Recovery Estimate | Confidence |

|---|---|---|---|---|

| Ryazan Refinery 17.1M tons/year | Isomerization unit destroyed Hydroprocessing unit damaged | DEGRADED 30-50% loss | 60-90 days | HIGH |

| Syzran Refinery 8.5M tons/year | Large fire and explosions Extent under assessment | DISRUPTED 60-100% loss | 30-60 days | MED |

| Livny Depot Storage facility | Two storage tanks destroyed ~25,000 bbls product lost | OPERATIONAL Reduced storage | N/A | HIGH |

Ryazan Oil Refinery: Isomerization Unit Destroyed

The December 6 strike on the Ryazan refinery represents the ninth successful Ukrainian drone attack on this facility since the campaign began. Satellite imagery analysis confirms the destruction of the Izomalk-2-LIN-800 isomerization unit, a critical component for producing high-octane gasoline. The facility, which processes 17.1 million tons per year and supplies the Moscow region, operated at near-full capacity prior to the strike.The isomerization unit converts low-octane naphtha into high-octane gasoline blending components. Without this unit operational, the refinery faces two immediate constraints.

First, total gasoline output will decline by an estimated 30-50% as the facility loses its ability to upgrade lower-value feedstocks. Second, the remaining gasoline production will be of significantly lower octane rating, reducing its value and utility for the domestic market.

Repair timelines for this specific unit are estimated at 60-90 days under normal conditions. However, current sanctions severely restrict Russia's access to the specialized catalysts and control systems required for isomerization units. Western suppliers, including UOP (Honeywell) and Axens, have ceased operations in Russia. This extends the realistic recovery timeline and increases the probability that repairs will result in degraded unit performance even after restoration.

|

Ryazan Refinery - Post-Strike

Source: United24 Media / Maxar Technologies. Annotated image shows the location of the targeted isomerization unit. |

Syzran Refinery - Night of Attack

Source: Kyiv Independent / Social Media. Image shows a large fire raging at the Syzran facility on Dec 5, 2025. |

Syzran Oil Refinery: Major Fire and Operational Disruption

The December 5 strike on the Syzran refinery in the Samara region triggered a large fire visible in open-source imagery and social media reports. The facility, with a capacity of 8.5 million tons per year, serves the southern Volga region and is a key supplier of diesel and jet fuel to both civilian and military consumers.

Visual evidence from the night of the attack shows multiple explosion points and sustained fire across the primary processing area. The scale and intensity of the fire suggest damage to atmospheric distillation units or catalytic cracking units, both of which process large volumes of volatile hydrocarbons. Preliminary assessment indicates a 60-100% loss of operational capacity, though this remains subject to revision pending higher-resolution satellite imagery.

Recovery timelines for the Syzran facility are estimated at 30-60 days, shorter than Ryazan due to the possibility that damage may be concentrated in ancillary systems rather than primary processing units. However, this assessment carries medium confidence until post-fire damage can be fully evaluated through satellite analysis.

Livny Oil Depot: Storage Capacity Reduced

The December 2 strike on the Livny oil storage depot in the Oryol region destroyed two storage tanks containing an estimated 25,000 barrels of refined products. While this represents a tactical loss of stored inventory, the depot remains operational with reduced storage capacity. The facility continues to serve its distribution function for the region.

Impacts: Oil Market and Russian Economy

The direct market and economic impacts of the strikes are most acute in the Russian domestic refined product market, while global crude markets showed minimal response.

Global Crude Market Analysis

Global crude prices remained unresponsive to these specific strikes. Brent crude fell from $64.22/bbl on December 1 to approximately $62.90/bbl on December 8 2, a decline of 2.1% that aligns with broader market trends rather than a reaction to the refinery attacks. This muted response indicates that global markets have priced in the ongoing risk to Russian refining capacity and distinguish between threats to crude production or export infrastructure versus threats to domestic refining.

The lack of price response reflects two market realities. First, Russian crude production and export capacity remain largely intact, meaning global supply fundamentals are unchanged. Second, the market has observed sustained Ukrainian attacks on Russian refineries throughout 2025 and has incorporated this risk into baseline pricing assumptions.

Russian Domestic Market Analysis

The domestic impact is severe and contributes directly to the ongoing 2025 Russian Fuel Crisis. The estimated 180,000-300,000 bpd of offline capacity from these strikes represents 3.6% to 6.0% of Russia's total refining capacity of approximately 5 million bpd. This compounds the 15-20% of capacity already under repair from previous attacks, creating cumulative stress on the domestic refined product market.

The loss of high-octane gasoline production from the Ryazan facility is particularly significant given existing shortages. Russia has maintained a gasoline export ban since August 2025, extended through May 2026, in an attempt to prioritize domestic supply. Despite this measure, regional shortages persist, with price controls masking the severity of supply constraints. Russian domestic gasoline prices are held at 65.47 RUB/L ($0.85/L) and diesel at 75.06 RUB/L ($0.97/L) through government intervention, while actual market-clearing prices would be substantially higher.

The government response includes regional rationing, priority allocation to military and agricultural sectors, and restrictions on diesel exports. Russian oil revenues have fallen to their lowest levels since 2022 according to IEA data from November 2025, driven by the forced shift from high-margin refined product exports to low-margin crude exports.

Sources and References

[2] "Ukraine says it attacked Rosneft Syzran refinery, Azov Sea port," Bloomberg, December 5, 2025,

[9] "Ryazan refinery," Wikipedia, accessed December 8, 2025,

[11] Air Force Doctrine Publication 3-60, Targeting, U.S. Air Force, May 8, 2019,

[14] "Top Satellite Imagery Companies: A Comprehensive Comparison," Felt, accessed December 8, 2025,