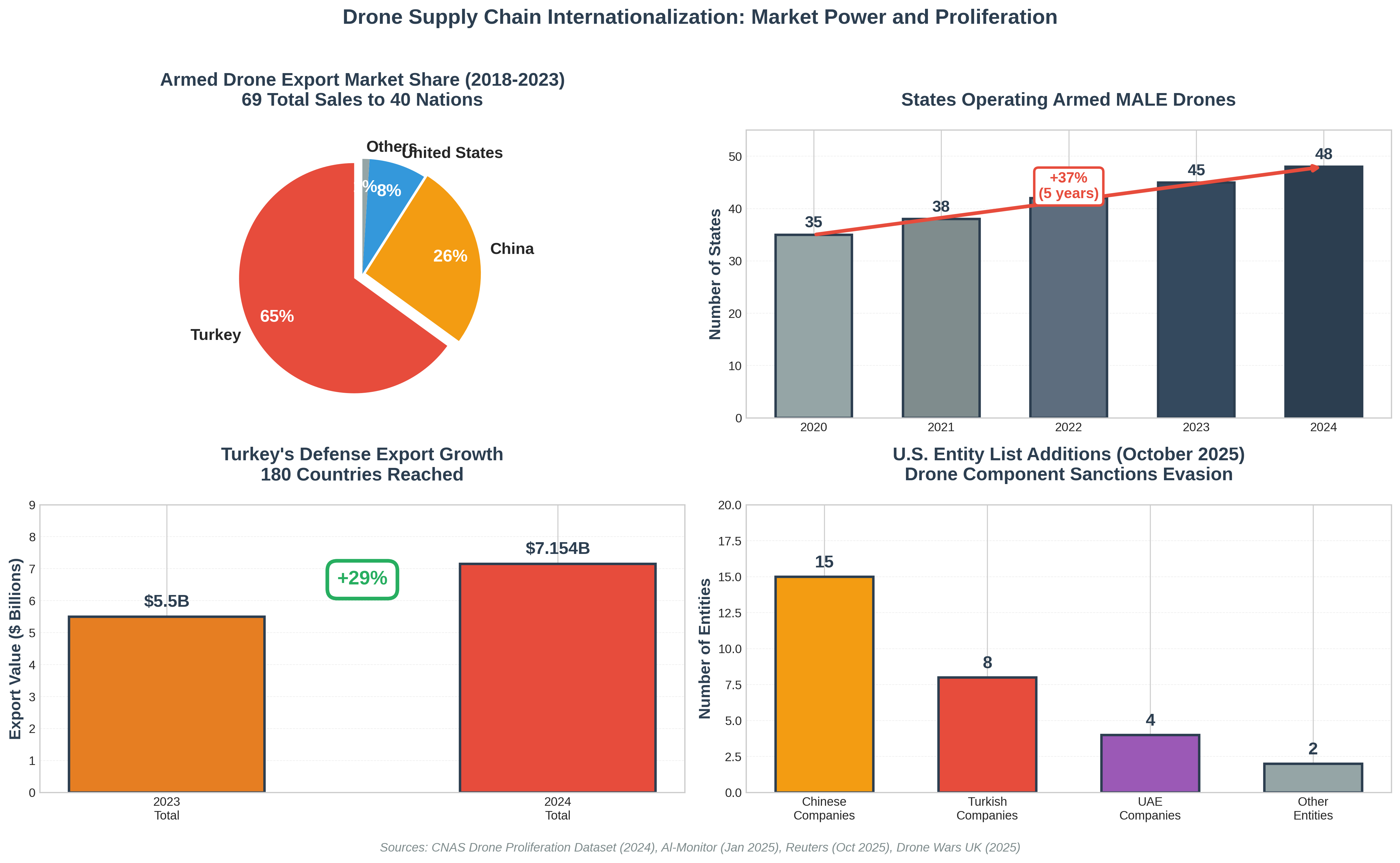

The global market for armed unmanned aerial vehicles has undergone a structural transformation between 2018 and 2023. Turkey captured 65% of all armed drone sales during this period, executing 45 of 69 total transactions across 40 recipient nations. China accounted for 26% of sales, while the United States, despite maintaining technological superiority in platform capabilities, completed only 8% of transactions. This redistribution of market share reflects the collapse of the Western export control consensus and the emergence of suppliers operating outside the Missile Technology Control Regime (MTCR) framework.

The commercial implications are significant. Turkish defense exports increased from $5.5 billion in 2023 to $7.15 billion in 2024, a 29% annual growth rate driven primarily by unmanned systems. Baykar, the privately held manufacturer responsible for the majority of Turkish drone exports, acquired Italian aviation firm Piaggio Aerospace in December 2024 and established a joint venture with Leonardo SpA to penetrate the European market. Turkish platforms now operate in 180 countries, including NATO members Spain and Latvia, creating dependencies that complicate alliance coordination on export policy.

Component Supply Chains and Sanctions Circumvention

The proliferation of finished platforms is enabled by a globalized supply chain for critical subsystems. Chinese manufacturers dominate production of motors, electronic speed controllers, flight management systems, and electro-optical payloads used across the industry. This creates a structural vulnerability in Western export control strategy. While governments restrict sales of complete military systems, the components required to construct equivalent capabilities flow through commercial channels with minimal oversight.

The U.S. Commerce Department added 15 Chinese companies to the Entity List in October 2025 for facilitating the transfer of components to Iranian proxy forces. Weaponized drones recovered by Israeli Defense Forces after the October 7, 2023 attacks contained U.S.-origin electronics sourced through Chinese distributors. Arrow Electronics, a Colorado-based firm with $28 billion in annual revenue, had subsidiaries in Shanghai and Hong Kong implicated in these supply chains. The company stated it was operating in compliance with regulations and would work with the Bureau of Industry and Security to resolve the listings.

The sanctions evasion network extends beyond China. Turkish and UAE-based entities were also added to the Entity List in October 2025, indicating the geographic dispersion of procurement networks. Iran's supply of Shahed-series drones to Russia, Hezbollah, and Houthi forces demonstrates the operational effectiveness of these circumvention strategies. The drones contain Western components acquired through intermediaries in multiple jurisdictions, making interdiction difficult without comprehensive supply chain visibility.

Proliferation Metrics and Operational Deployment

The number of states operating armed Medium Altitude Long Endurance (MALE) drones increased from 35 in 2020 to 48 in 2024, a 37% expansion over five years. This proliferation has been accompanied by a documented increase in operational use. Drone strikes in conflict zones increased by an estimated 4,000% between 2020 and 2024, according to multiple open-source databases. In Africa alone, 484 drone strikes were recorded in 2024, resulting in 1,176 casualties across 13 countries. Sudan accounted for 264 strikes, Sahel nations for 145, with the remainder distributed across other theaters.

The January 2024 attack on Tower 22, a U.S. facility in Jordan, marked the first confirmed instance of American military personnel killed by a drone operated by a non-state actor. The attack demonstrated that commercially derived platforms could achieve tactically significant effects against hardened targets. Militant groups in the Sahel have shifted from direct engagement tactics to standoff drone attacks, a pattern consistent with the operational adaptation observed in Ukraine and the Middle East.

Strategic Implications for Export Control Architecture

The current export control framework, built on the assumption of limited supplier diversity and high barriers to entry, is no longer effective. Pakistan's procurement strategy illustrates the new paradigm. Islamabad operates Turkish Bayraktar TB2 systems alongside Chinese CH-4 and Wing Loong platforms, creating redundancy that insulates the program from unilateral sanctions. This dual-sourcing model will be replicated by other states seeking to avoid dependency on Western suppliers subject to political conditionality.

Ukraine's domestic drone production, which reached 2.2 million units in 2024 and is projected to exceed 4.5 million in 2025, relies heavily on Chinese components despite Beijing's restrictions on direct sales. This indicates that component-level controls are circumvented through third-party distributors and gray-market channels. The speed of Ukraine's production ramp demonstrates that states with modest industrial capacity can achieve scale in drone manufacturing if component access is maintained.

China's October 2024 restrictions on drone and component exports to Ukraine were intended to constrain Kyiv's production capacity. The restrictions have had limited effect, as Ukrainian manufacturers source through intermediaries in third countries. This pattern will repeat in future conflicts where belligerents have access to global commercial supply chains. The dual-use nature of drone components makes comprehensive export controls impractical without disrupting legitimate commercial activity.

Conclusion

The internationalization of the drone supply chain has created a market structure resistant to unilateral export controls. Turkey's 65% market share in armed drone sales reflects demand for platforms unconstrained by Western political conditions. China's dominance in component manufacturing provides the industrial base for global proliferation, including to non-state actors. The 37% increase in states operating armed drones between 2020 and 2024, combined with the 4,000% rise in operational drone strikes, indicates that this technology has become a standard tool of modern conflict.

Traditional export control mechanisms, designed for integrated platforms sold through government-to-government channels, cannot address a market characterized by modular systems, commercial components, and distributed manufacturing. The Entity List might expand, but it will come no closer to reflecting system control with the current trajectory of production proliferation.